Keja Connect 0 Comments 379 Views

The Best Strategies for Investing in Real Estate for Beginners in Kenya

What are the best strategies to invest in real estate in Kenya?

Real estate investments are game-changers when it comes to financial independence because they offer long-term stability and value appreciation. Kenya's real estate sector is one of the hottest in this part of Africa, going through rapid growth driven by urbanization, infrastructure development, and a rising middle class. However, if you don't know what you're doing and how this market works, getting into real estate is truly intimidating. The blog post articulates the best strategies through which beginners can effectively invest in real estate in Kenya.

Do Market and Research

One ought to be well-versed with the Kenyan real estate market before making any kind of investment. Key factors can be identified from the market trends, economic outlooks, and emerging hotspots.

- Market Trends: Real estate in Kenya is heavily informed by infrastructural development, urbanization, and demand for housing. Infrastructural development works on roads and further expansion of services, such as water and electricity, have benefited places around Nairobi, for example, in Syokimau, Ruaka, and Kitengela.

- Emerging Markets: Due to decentralization and the growing urban population, Kisumu, Eldoret, and Nakuru are slowly turning into new emerging markets for real estate growth.

Research can be conducted through:

- Online platforms like Jiji, BuyRent Kenya, Property24, and KejaConnect give out an overview of properties and current prices.

- Checking in with real estate agents to get the scoop on market trends and emerging opportunities. With this understanding, you can decide appropriately on the investments.

Start Small with Affordable Properties

If you are a beginner, you don't have to jump into luxury homes or commercial buildings. You can start with affordable residential property. Kenya has a growing demand for low- to middle-income housing, which provides an excellent opportunity for entry-level investors.

These are:

- Apartment: Apartments are more affordable compared to standalone homes. Their rental income remains quite stable.

- Plots: Purchasing land in quickly developing locations is a good investment for the long term, as the price of properties appreciates over time.

Starting small reduces your initial financial risk while giving you a feel for managing real estate. As you gain experience and capital, you can diversify into more complex projects.

Use Finances to the Advantage

Many people shy off from real estate because of the perceived high capital requirements. However, available financing options in Kenya will help you invest without needing large sums upfront.

- Mortgages: Most banks in Kenya, among them KCB, Co-operative Bank, and Absa, have an arrangement where one can acquire a mortgage and pay in monthly installments for several years to purchase property.

- SACCOs: Savings and Credit Cooperative Societies give cheap and flexible loans for investment in real estate. Most Kenyan people investing in real estate prefer SACCOs because, generally, the interest rates are low compared to what traditional banks offer.

- Real Estate Investment Trusts (REITs): If you're not ready to buy physical property, consider investing in REITs. These are pooled funds that invest in income-generating real estate, giving you exposure to the property market without direct ownership.

Location is Key

As they say in real estate, "Location, location, location." The success of your investment will largely be hinged on the where. When choosing for location, the following factors should be considered:

- Infrastructure Proximity: Property that is close to new infrastructure for example roads, schools, hospitals, or shopping malls is likely to be appreciated at a faster rate.

- Urbanization trends: Considering the rapid growth in urbanization of cities like Nairobi, Mombasa, and Kisumu, an investment in the outskirts or upcoming suburbs is bound to appreciate a great deal. These have less costly properties with a lot of potential for capital appreciation.

- Safety and infrastructure: Consider the areas where essential services such as water, electricity, and public transport are provided; also go for areas with low criminal activities. For example, in Nairobi, the most popular areas with inexpensive housing are Ruiru and Juja, close to the major highways.

Invest in Rental Properties for Passive Income

Real estate, particularly the investment in rental property, remains the best way to sustain earnings. The demand for rental housing in Kenya is relatively high, especially in urban areas with a steadily increasing population like Nairobi, Mombasa, Nakuru, and Kisumu.

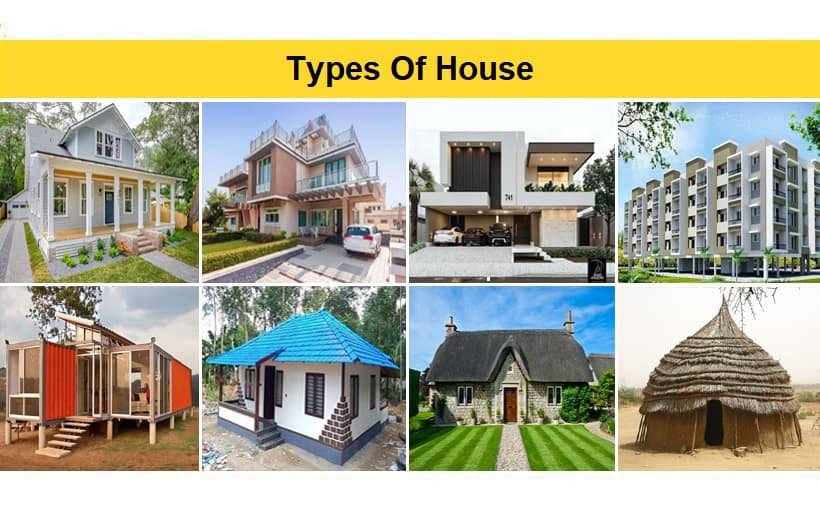

Types of rental properties include:

- Apartments or flats: In busy urban centers, apartments are known to offer high rental yields.

- Single-Family Homes: In developing suburbs, single-family homes can attract long-term tenants.

Be informed, indeed, about the rental demand of your selected location. For instance, towns that host universities like Eldoret (Moi University) or Thika (Mount Kenya University) always have a high demand for student rentals, which could give you a steady monthly income.

Land Banking

Land banking is another good strategy if you are not in search of immediate returns. This involves buying land in developing areas and holding onto it until its value rises. There is a rise in prices of the land within the outcasts or rural places when cities expand, translating to a high return on investment when you decide to sell.

Places like Kitengela, Ngong, and Athi River are fast-growing areas, so land banking could be a good area to invest in. This is really an incredible strategy if you are a patient person looking forward to appreciation in the long run rather than quick gains.

Team Up with Experts

Last but not least, as a beginner, it is only wise to engage with professionals who will help you shun common pitfalls and smartly make investment decisions. Consider working with:

- Real estate agents: They share the market trends and give an insight into the values of property while also identifying investment areas.

- Legalities: Ensure all transactions are legal by working with a well-known attorney specializing in real estate law.

- Property managers: If you invest in property to rent it out, then a property management company helps you deal with tenant issues, maintenance, and collection of rent.

Real estate investment is not about a one-man show. Working with professionals will protect your investment and ensure you're making calculated decisions at every step of the way.

Kenya real estate investment is one of the most promising ways to amass wealth. It, however, calls for due consideration before making any decisions. To start with research on the market, choose the right location, and then consider affordable financing. Whether one is considering rental properties, land banking, or simply buying a small plot, the diverse real estate market of Kenya offers something for each investor.

Following through with these strategies will see you on the right path to growing a successful real estate portfolio in Kenya. Remember to exercise patience and research, so take your time and make sure every step is calculated. Happy Investing!"}

0 Comments

Submit a Comment